Do I Need Travel Insurance?

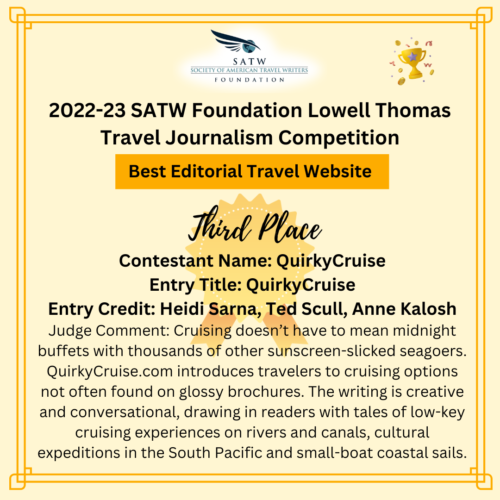

By Heidi Sarna

I had a chat with travel advisor Kevin Flink about travel insurance.

I met Kevin on a recent UnCruise in Alaska, where we had the opportunity to discuss the pros and cons of travel insurance. Kevin knows a lot about insurance as he’s in the field researching and selling travel every day, so his insights are very useful for us all, especially if you're wondering, “do I need travel insurance?”

QC: Thanks for sharing your travel insurance insights with us.

Kevin Flink of Cruise Planners: Thank you for the opportunity. It’s a tricky topic because it can be expensive and it’s often an afterthought for some travelers. But in most cases I believe travel insurance is essential for safety and to protect your travel investment.

Travel advisor Kevin Flink on an Alaska UnCruise adventure, where Heidi met him. * Photo: Kevin Flink

QC: Tell us about your background.

Kevin Flink of Cruise Planners: Whether it’s helping clients navigate all the choices around travel insurance, planning a small-ship expedition cruise with their friends, or crafting a milestone anniversary to a tropical resort, I focus on my clients’ needs. I invest the time to learn what my clients want, and then help them create a personalized, seamless vacation experience, anywhere in the world, and at a better value than if they booked it on their own.

I own a franchise with Cruise Planners, one of the highest producing land and cruise travel agencies in the world, which means travel suppliers want my business.

Cruise Planners give me various perks, like a dedicated account manager, for when I need to escalate a client’s urgent problem, and bonus discounts and freebies for my clients to use on top of public sales.

When I’m working on a trip for my clients, I know I’m saving them many hours of planning and typically saving them money, too.

QC: Do you recommend your cruise clients buy travel insurance?

Kevin Flink of Cruise Planners: I highly recommend purchasing travel insurance for all international travel. Life is unpredictable.

Travel insurance fills both of these gaps in coverage:

- Things change, yet travel suppliers have rigid policies that levy penalties for cancellations.

- Unforeseen accidents happen to everyone, yet almost all US healthcare plans are invalid internationally.

Travel insurance helps to protect against unforeseen risks like a trip cancellation or interruption.

Accidents, ailments, and cancellations are a fact of life, especially post-COVID. Those expenses would be 100% out-of-pocket without travel insurance, and could end up being a six-figure medical bill in case of an emergency while traveling.

Here’s an example of the most common way travel insurance helps:

Recently I had a couple cruising through the Mediterranean who unfortunately caught COVID with a few days left onboard. They missed out on some excursions for those lost days and then also missed a few days of pre-planned tours around Rome afterward while they were recovering.

They ended up spending thousands of dollars in healthcare costs and in penalties from everything they had to cancel.

But they had peace of mind because they knew they were protected with the right kind of travel insurance policy. They could focus on getting better without worrying so much about the financial side.

When they got home, I helped them file their insurance claim and they were reimbursed for everything (no deductible!).

Kevin Flink owns a franchise of Cruise Planners.

Choices, Choices — So Do I Need Travel Insurance?

QC: There are so many insurance choices, it’s overwhelming. Which insurance company do you recommend and why?

Kevin Flink of Cruise Planners: Every insurance company offers various policies that include different terms, benefits, rules, and customer service, so nothing is apples-to-apples when comparing options.

The travel insurance policies I recommend to my clients are custom policies from my franchisor parent company, Cruise Planners, that are put together with Allianz, a top-ranked travel insurance company and the world’s largest.

These policies are tailor-made for the needs of luxury travel, offering richer benefits and better support than other insurance products. Plus, Allianz’s travel insurance offerings are customizable to the trip and client, and they apply to the full trip, not just the cruise, which can be just a fraction of the total trip cost.

The policies we offer typically cost the same or less than those offered by the cruise lines, yet they offer richer benefits.

Almost all of my small-ship clients add travel insurance with most choosing the custom policy Cruise Planners offers through Allianz.

Most of them do not opt for the cruise line’s own insurance product because those policies tend to cover only the cruise, and not any pre- and post-hotels, flights and tours.

Subscribe to our monthly small ship cruise email

Subscribe to QuirkyCruise.com for monthly curated newsletters highlighting our top small cruise ship reviews, round-ups & offers!

Travel Insurance Options

QC: Is there a one-size-fits-all Allianz insurance product you offer? If not, what are a few of your main options?

Kevin Flink of Cruise Planners: You could say there’s a ‘one-size-fits-most’ product. Ninety percent of my clients who add travel insurance get one type of policy — a policy that covers their full trip, the only kind that covers pre-existing conditions.

I think you could summarize what most travelers buy into four buckets:

- Travel insurance that covers the full trip, both travel and medical costs.

This kind of insurance is required if you want to insure pre-existing conditions. Full-trip coverage would include, for example, the cost of the cruise, flights, hotel nights before and after, tours and major medical benefits like medical evacuation.Overall, there’s a list of covered reasons on every policy and the Allianz list is hands- down more inclusive than any other insurance company I’ve seen. The cruise line policies usually have fewer covered reasons. - Travel insurance that covers only part of a trip, such as medical and lost bags coverage.

This option is an alternative offered to help clients get medical coverage at a lower premium (but at the risk of not having full cancellation coverage). - A travel insurance policy that lasts for one year.

This lasts one full year and covers all travel in between, up to policy limits. This offers a lower premium and lower benefits, but it's more flexible for frequent travelers as they don't have the hassle of buying new insurance for each trip. - Cancel-for-any-reason insurance.

Travelers can receive up to 80% reimbursement for any reason. It is the most expensive and the most flexible of all the four plans. It has the same rich benefits of the regular full plan insurance, but with the extra benefit of a traveler being able to cancel for a non-covered reason and still get coverage up to 80% with no questions asked. So it costs more for that extra flexibility.

Some insurance products, especially ones provided by travel suppliers, are not customizable. They’re pre-set with the same benefits and cost for any traveler and any itinerary. I don’t recommend these policies as they usually have low benefits that wouldn’t cover realistic expenses, and come with an unfair amount of exclusions and red tape.

I recommend option #1 — travel insurance that covers the full trip and includes pre-existing conditions — for everyone unless travelers are looking for a lower premium or more flexibility.

When comparing travel insurance policies, if one is priced less than another, there’s a very clear and measurable reason why. Usually, it’s because some key benefits are either missing and/or fewer benefits are offered.

A good travel advisor will help clients compare policies and navigate their options to best fit the client’s needs. Insuring every dollar of a trip isn’t always necessary.

Choosing the best travel insurance comes down to a traveler’s individual risk tolerance, budget and how flexible the insurance policy is.

I sit down with my clients and show them what it would cost to insure the full trip, what benefits they would have access to; if they want a lower premium, I show them what benefits they can get at a price point they are comfortable with.

A really helpful article on CNBC.com by Megan Leonhardt spells out the pros and cons of travel insurance quite well.

Here’s an excerpt:

“There are generally two kinds of trip insurance:

- Basic trip cancellation protection, which usually covers lost bags, reimbursements if you miss a connection and a refund if you can’t travel because you’re sick or hurt.

- Comprehensive travel insurance, which typically covers all that, plus any expenses related to medical or dental emergencies, disaster evacuations and even costs associated with accidental deaths. Basically this is a combo of travel and medical costs.

If you’re going to get trip or travel insurance (the two terms are pretty much interchangeable), experts usually recommend the comprehensive kind. You can even purchase a policy that comes with a “cancel for any reason” safeguard, which is ideal if you’re traveling to places that might experience political unrest.

If you haven’t paid extra for the “cancel for any reason” policy, you’ll likely encounter strict guidelines for when you’re eligible for reimbursement. For example, if you get sick before a trip, you’ll need to get a doctor’s note before cancelling if you want to be reimbursed…”

Benefits of Travel Insurance

QC: So what is the single most important benefit of travel insurance?

Kevin Flink of Cruise Planners: The single most important benefit is having some level of emergency medical coverage for international travel. Unforeseen accidents happen to everyone, and we take for granted how little coverage our regular medical insurance offers.

The true cost for emergency medical care while traveling can be jaw-dropping, yet it can be prevented in most cases for $100 worth of insurance that includes medical evacuation.

Again, as it’s an important point. The things you won’t get when not insuring the full trip are:

- pre-existing conditions coverage

- cancellation coverage higher than the amount insured — i.e. a $1,000 cruise insured at $500 can only receive a $500 reimbursement

No question, everyone should have travel insurance for international travel that in the least includes medical coverage.

QC: What are the benefits of buying travel insurance through you and not directly with an insurance company?

Kevin Flink of Cruise Planners: Here are the three main reasons:

- Personal Service: Travel insurance can feel complicated, overwhelming, and expensive. A good travel advisor can help ease a traveler’s concerns. I’m a real person, not some call center where every time you call it’s a different scripted robotic person on the other line. I save my clients countless hours of researching, waiting on hold, discussing questions with insurance companies, explaining options to clients, and I even advocate for my clients and help manage their claims. Then, when life happens or trips need to change, I hold my clients’ hands through the process, taking care of the heavy lifting with the travel suppliers so my clients don’t have to.

- Expert Advice: I have helped many clients navigate the unfortunate circumstance of needing to file travel insurance claims. My years of experience planning trips for clients to every continent, my personal travels, and my training as a certified luxury travel specialist with most of the top international travel suppliers and tourism boards, helps me better advise my clients on tricky topics like insurance.

- Customization: Travel insurance is a question of risk tolerance. There’s no right or wrong answer. That’s why I think travelers should have options. Yet travel suppliers typically push one rigid insurance policy that doesn’t even cover the full trip. My clients appreciate that I have access to multiple superior insurance products that are customizable to fit what they’re comfortable with — and that I help them through the process.

Dollars and Cents

QC: What does travel insurance cost?

Kevin Flink of Cruise Planners: Good policies that cover a full trip are based on age and trip cost; the age brackets can range from a 5%-25% premium.

Most travelers pay 6%-11% of the trip cost for the Allianz policies I typically recommend.

Here’s an example:

A 55-year-old traveler spending $5,000 on a small-ship cruise vacation (including a few nights in a hotel and airfare) might have an insurance premium around $350 when insuring the full trip (which would come in at 7% in this case).

Likewise, a $15K trip (including a small-ship cruise and a week of hotels, for example) would have an insurance premium of around $1,000 or so. Both would include medical and emergency evacuation.

For travelers who want a lower premium, if they book through a good travel advisor, they may get access to a much lower premium — even just $30. And it would still include the same medical benefits. For example, two notable benefits on my policy are $50,000 in medical care and $1M in emergency evacuation. My clients receive those same medical benefits whether they insure the full trip or just part of the trip.

What the partial, less-expensive policy would not receive is meaningful cancellation coverage (of a canceled cruise) or coverage for pre-existing conditions.

So, if a conflict came up and a traveler needed to cancel their trip for a covered reason (such as needing a medical procedure), then the person with full travel insurance would get full reimbursement for any penalties, while the person with a $30 policy would receive about $300 towards the cost of the canceled cruise (assuming a 10% premium).

Yet if while traveling they both had a slip-and-fall accident and broke their wrist in a remote jungle, then they would both receive the same $50,000 medical and $1M evacuation benefits. In summary, when cancellation coverage is important, travelers should insure the full trip.

Conversely, when medical benefits are the priority, travelers can opt for less coverage (resulting in a lower premium), and still receive the full medical benefits.

Having no medical benefits is a risky choice that I think travelers only opt for when they don’t realize (or don’t have access to) a flexible travel insurance policy sold by a good travel advisor.

In a nutshell, Kevin advises:

- Get travel insurance for all international trips.

- Choose either the full plan (which is more expensive, about 6-11% of total trip cost, but includes pre-existing conditions and full medical with evacuation).

- Choose a more limited plan (which is cheaper, as little as, say, $100 total, and doesn't include everything, but does include medical with evacuation).

- Travel insurance isn't necessary for domestic trips if you have good health insurance and some coverage on your credit card. But DO buy insurance for pricey domestic trips in the five figures ($10K +).

When Is Travel Insurance Not Needed?

QC: Do you ever tell a client travel insurance isn’t necessary?

Kevin Flink of Cruise Planners: I advise my clients to purchase travel insurance whenever there would be a gap in medical coverage without it, which is usually for international travel.

For domestic travel, if you have good health insurance and/or some coverage on your credit cards, then you may want to skip buying travel insurance.

When I sell inexpensive domestic trips, I don’t recommend insurance. But when the total trip cost hits five digits, then I advise them to get insurance.

QC: Thank you Kevin! That’s a lot of very useful information to digest.

Kevin Flink of Cruise Planners: My pleasure. Your Quirky Cruisers are welcome to reach out to me for their small-ship quirky cruise and travel insurance needs!

You can reach me at [email protected].

We hope our article answers your question, “do I need travel insurance?”

Safe travels!

![]()

Don’t miss a post about small-ship cruising, subscribe to QuirkyCruise.com for monthly updates & special offers!

© This article is protected by copyright, no part may be reproduced by any process without written permission from the author. All Rights Reserved. QuirkyCruise.com.

HEIDI SARNA

HEIDI SARNA