Travel Insurance Tips from Charlie and Sherrie Funk

By Charlie & Sherrie Funk

Sherrie Funk started the first cruise-only travel agency in Tennessee in 1988. Her husband, Charlie Funk, joined her full-time in 1993. The pair ran Just Cruisin’ Plus for 40 years. They are nationally known trainers and speakers sharing their travel tips and insights, and were named to the Cruise Line International Association Hall of Fame in 2012. Today they operate CSF Travel Consulting.

When we first became travel advisors focused on selling cruises, it was a time when airlines were reliable to the point that one could fly to the departure port on the day of sailing with confidence in a timely and safe arrival.

We were young and healthy enough that the prospect of canceling a cruise because of illness was a far-distant thought.

Besides, Charlie’s somewhat condescending (okay, a lot condescending) attitude was that selling travel insurance was beneath him and so there wasn’t much effort put into offering insurance. In fact, client requests were mostly responsible for the few policies sold.

As we gained experience, we became aware of anecdotes recounting a litany of events. Some clients were protected by travel insurance, most were not protected at all, and that led to a much different outlook and philosophy on the matter.

Charlie & Sherrie Funk. * Photo credit: The Funks

What is Travel Insurance?

As we learned, this product called “travel insurance” included far more than protection for just the travel component.

Lost/misdirected luggage protection became important when Charlie flew to New Orleans for a cruise and his luggage went to Aruba.

Whenever we're asked about what to look for when buying travel insurance, we always stress that good travel insurance coverage should always include these protections:

- Evacuation benefits – covers evacuation costs, up to the specified limit, for evacuation made necessary by natural disaster, civil unrest, etc.

- Baggage loss – covers lost item(s) replacement cost, up to the specified limit.

- Trip delay – as airline on-time performance slipped, it became far more frequent for travelers to find themselves stranded in a connecting city on the way to the cruise port. This benefit covers additional costs, subject to the specified limit, arising as a result of flight delays.

- Single occupancy – your reservation is double occupancy and your traveling companion cancels. You decide to go anyway. The supplier assesses a single occupancy surcharge. This benefit covers that cost, up to the specified limit.

- Travel medical assistance – this benefit covers medical expense, up to the specified limit. This can be especially important if your medical insurance has out-of-country coverage restrictions. Read on for a personal anecdote that illustrates why this coverage is even more in some circumstances.

- Pre-existing condition coverage – a malady flares up again and it is necessary to cancel your trip. Most insurance suppliers offer loss coverage for this event as long as the insurance is purchased within some number of days after initial trip payment, usually 14 to 21 days.

- Supplier default – your trip supplier becomes insolvent and your trip is cancelled. This coverage reimburses you for resulting losses, up to the specified limit. IMPORTANT NOTE – most insurance companies do not offer this protection if your policy was purchased through the travel supplier. This alone is a compelling reason to buy your policy through a third party, such as a travel agent or other third-party entity, even if you didn’t book your travel though them.

A Number of Factors Determine the Premium You'll Pay for Your Policy:

- Trip cost – pretty straight forward. More expensive trips cost more to insure.

- Trip length – again, pretty straight forward, as the insurance company’s loss exposure increases the longer you are away on your trip.

- Your age – the harsh reality is that as we become more life-experienced, the probability of having to file a claim increases non-linearly to the point that your policy may cost as much as 12% or more of your trip cost (vs 8 to 10% for younger folks).

Subscribe to our monthly small ship cruise email

Subscribe to QuirkyCruise.com for monthly curated newsletters highlighting our top small cruise ship reviews, round-ups & offers!

Speaking of Age, We’ve Often Been Asked if Young People Need Travel Insurance

One of our top travel insurance tips is that every age needs it. A lot of young people don’t have health insurance, and so travel insurance will assure they have some medical coverage.

For instance, Travel Guard has a Pack ‘N Go policy that does not have trip cancellation/trip interruption coverage, but has a medical policy. Specifically for this purpose, our rep with Travel Guard bought this policy for his 28-year-old son whenever he travels as he doesn’t have health insurance.

And Do you Need Travel Insurance if You Are “Just” Traveling Somewhere Nearby?

Most people don’t think they need travel insurance to travel domestically because they have health insurance in the U.S. or Canada. Or they choose travel insurance without medical coverage.

(QuirkyCruise co-founder Heidi chimes in here: “We live in the US and our health insurance policy covers, to some extent, 'emergency' care that's defined as a ‘matter of life and limb' in any state in the US. Our insurance plan does not cover any medical incidents that might occur while we're traveling outside of the country.”)

However, as you will read (below), our domestic trip to Sedona was a $222,000 incident where the combination of our health insurance and travel insurance had us only $3,000 out-of-pocket. This could have been devastating to anyone who got slammed with that kind of financial hit.

We are definitely the poster children for travel insurance.

And that brings us to another point.

Why is Travel Insurance So Expensive?

This is one of the travel insurance questions we get often. The short answer is “Because it is used so often.”

Consider all the things that could possibly go wrong with something that has as many moving parts as a cruise, with airfare, shore excursions, weather issues, and more, and the question almost becomes “why would any company even offer trip insurance?”

See further along (below) some prominent providers in the trip insurance/protection space to give you a resource to compare coverage.

Be sure you understand what the words and phrases in the coverage description mean.

Basically, trip insurance, travel protection, and cancellation waivers are totally different products even though some purveyors may, incorrectly, use the terms interchangeably.

What is NOT Travel Insurance

Another important piece of travel insurance advice we love to share is — “trip protection” is not travel insurance. Period.

- Travel Insurance – this is a closely regulated product that covers losses incurred while traveling, to include the examples shown above and more.

- Trip Protection and Cancellation Waivers – these are unregulated products that some travel companies offer that allow you to waive a cancellation fee if you can’t travel. Some allow you to receive a credit for all or part of your trip cost. This product will typically cost less than true insurance.

As you work your way through the selection process, you’re likely to find that the premium varies greatly from one supplier to another.

Here’s the facts — insurance companies have entire teams of people whose sole responsibility is to assess the likelihood of a loss, and the expected size of that loss. That information is then used to compute a premium for the coverage offered that will be competitive enough to make a sale but still be profitable in the end. They are not given to wild guesses or pie-in-the-sky premium insurance loss calculations.

We said that to say this — if there is a substantial premium difference between two prospective quotes you arrived at, we guarantee the cheaper one has commensurately poorer protection, exclusions, or other differences that produced the lower premium cost.

Some companies, most notably cruise lines, often bundle protection as part of a travel insurance product — for example, river cruise line insurance is typically underwritten by one of the travel insurance major companies.

There are good bundled insurance options from some cruise lines, including many river cruise lines, but you need to be sure you read the fine print carefully to be sure you know what you are buying. Just because it walks like a duck, quacks like a duck, and looks like a duck does not mean it is a duck. You have to be your own best advocate.

Why is the Travel Insurance Industry So Heavily and Closely Regulated?

Because some 15 or so years ago, a plethora of unscrupulous, dishonest companies sprang up, many located in Florida, that sold protection under the guise of being insurance. Often, premiums were low and coverage attractive on the surface.

These ne’er-do-well thieves made handsome profits because either something on page 27, section 6, paragraph A, subsection xxvii excluded the cause for the claim, or they stalled and delayed payment, hoping the claimant would give up and go away, or they simply never intended to pay the claim in the first place.

Few sectors of the insurance industry are as tightly regulated as the travel insurance industry. That’s why you can rely on the companies mentioned further along to be reputable and trustworthy.

You’re probably wondering what sorts of things can arise that should lead you to buy trip insurance.

Here are three true stories:

- Some years ago, we had a client who refused to sign our insurance waiver which showed that the traveler had specifically declined our offer of insurance coverage for his $9,000 Alaska cruise-tour. In his words, “If I can fog a mirror, I’m going on this trip.” I am persuaded that God looks for people who tease Him to mess with them, because on Thursday before he was to leave on Saturday, he had a heart attack, quadruple bypass surgery, and wound up in intensive care. He could, indeed, fog a mirror but he wasn’t going on a cruise. His only refund was taxes paid on the cruise.

- We were in Sedona, AZ, in 2021, when Charlie’s gall bladder went septic and became gangrenous. He had to be life-flighted some 90 miles away to Phoenix, the closest area with critical care medical facilities. We had bought insurance through Travel Guard mainly for trip cancellation protection because we were in the U.S. and his medical insurance would surely cover anything arising. Wrong. The medevac (medical evacuation) cost alone was $46,000. Ambulance, copay and other medical costs quickly added up. Our six-day tour turned into a 21-day marathon. We needed housing for Sherrie and then Charlie after he was discharged following three surgeries in five days. Car rental, food expenses, etc., added up to over $8,000 out-of-pocket that was not covered by his medical insurance provider. Our travel insurance medical provision covered all but about $1,000 of that expense. The total cost for all medical, housing, car rental, return air tickets, and more totaled $222,000. After our medical insurance paid their portion and Travel Guard paid theirs, we ended up with only $3,000 that was not covered. Was the premium we paid for the additional coverage worth it? You betcha.

- The saddest example involved a former client, an insurance agency owner, who had begun booking all his travel on his own. While in Jamaica, he suffered a stroke and was financially unable to pay the $100,000+ cost for an ambulance flight back to the U.S. He did not have travel insurance. Let that sink in. He expired in Jamaica.

We guess the question we have for you is one that comes from Robert Ford, a friend of ours who is also a Travel Guard executive.

“You don’t want to buy travel insurance? What’s your plan? What’s your plan when your flight to Europe is cancelled? What’s your plan if you fell ill in another country while traveling and had to be treated/hospitalized? They need immediate payment or suitable coverage from a third party and you don’t have the cash or travel insurance. What’s your plan?”

In our opinion, “What’s your plan” ought to include the purchase of travel insurance.

Our Travel Insurance Recommendations — 5 of the Best Travel Insurance Companies

Here are a few leading companies and sellers in the industry we recommend that you consider.

Personally, we have always offered Travel Guard because of pricing and claim service.

Keep in mind, these insurance companies have various options to choose from for domestic trips in the US and they also provide international travel insurance options when visiting multiple countries.

So how to find best travel insurance plan? Which one do you choose?

There are so many options.

Because your cruise is unique to you, let your age, medical condition, and ports you will visit to help decide how much travel insurance coverage you need.

For example, medical coverage and evacuation coverage from a remote or developing country will be far more important if you’re going into remote Africa vs. taking a cruise in Western Europe.

Similarly, thousands of dollars coverage for lost luggage seems unnecessary if you’re traveling with a single carry-on bag.

Ted usually tries to travel with carry-on only. * Photo: Ted Scull

4 Top Travel Insurance Aggregators We Recommend

When you weigh the many different types of travel insurance coverage, take note that a number of companies act as insurance aggregators.

Similar to how Booking.com, Expedia and TripAdvisor represent many travel brands, insurance aggregators offer a variety of policies from many travel insurance companies. Insurance aggregators let you compare plans from a number of providers so you can make an informed decision on the best offering.

These four firms below are reputable travel insurance aggregators:

Aggregators are a beneficial choice for those who take time to read all the fine print before making a decision.

InsureMyTrip

Insurance aggregator InsureMyTrip has thousands of travel insurance plans and a one-of-a-kind recommendation engine to help travelers find the right plan.

Visit InsureMyTrip for a free quote to see how it works.

The Personal Touch

For me, I personally prefer getting human advice from someone more knowledgeable than I am.

Keep in mind, a hazard in selecting travel insurance based solely on premium cost is risky at best with the prospect that the insured will have inadequate coverage. This is perhaps the strongest reason to consult a live person who knows the questions to ask and how those answers fit into the matrix of the trip.

There are almost certainly other travel insurance options out there, besides the companies we've suggested above, but these we share as reputable choices from our experience in the business.

We hope that the main point that has come through is that travel insurance is a must for your upcoming and future trips, especially if you have pre-existing medical conditions or other special considerations.

And if you have decided you don’t need travel insurance …

What’s your plan?

![]()

Don’t miss a post about small-ship cruising, subscribe to QuirkyCruise.com for monthly updates & special offers!

© This article is protected by copyright, no part may be reproduced by any process without written permission from the author. All Rights Reserved. QuirkyCruise.com.

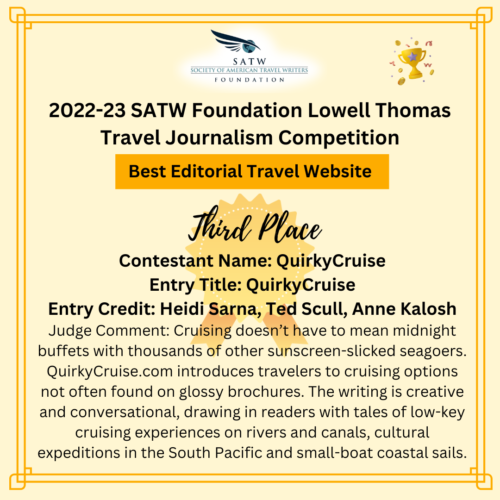

HEIDI SARNA

HEIDI SARNA

This is super-informative and comprehensive. You clarified a lot of things. Thank you!

Thank you, Charlie & Sherrie know the travel world better than just about anyone!

Thank you for your kind words. We are the poster children for travel insurance.

Thank you. Very useful. I always have travel insurance on my trips. I need to alert my grandniece on her new adventure. Teaching in Spain.

Thank you so much for your kind words. Definitely let your niece know about insurance. It seems younger people don’t see the need until it’s too late.

We were scheduled to travel to the Christmas Markets in Austria then on to Prague this past Thanksgiving., 2022. Almost a week before our departure I experienced a ruptured ulcer in my stomach. I spent Thanksgiving in the hospital after emergency surgery.

We had purchased insurance from Travel Guard and we received a full refund of our cruise tour, less the cost of the insurance. I’m here to say do not leave without travel insurance!

Thank you, Barbara. We missed having your and Eddie with us last year. You and I both know the need for insurance and have had to use it under medical circumstances.